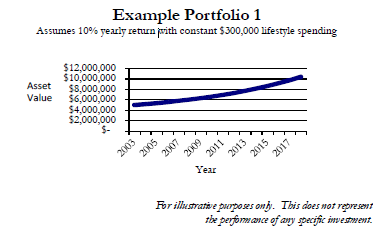

The two main lifecycle stages to be examined in investment management for an individual or family are accumulation and depletion. The accumulation stage is defined as the period when wealth accumulates faster than it is used (working life). The depletion stage is defined as the period when wealth use exceeds accumulation (usually retirement). When one is in the accumulation stage, market volatility appears to be of less concern than the depletion stage because the need to spend principal is relatively small. During the depletion stage, however, market volatility is of great concern because one’s lifestyle can be dependent on the stability of the investment markets. Understanding variability in the investment markets plays an important role when investing. Market volatility As investors and advisors we look for tools to help model the future. One way the investment industry deals with modeling the future value of assets is to apply a static, or average, expected return to a portfolio to determine if the return will satisfy lifestyle needs. This method of looking into the future is called the deterministic model. For example, if one were spending $300,000, or 6% of a $5,000,000 portfolio, on an annual basis and the average return of the portfolio based on asset allocation and historical returns is assumed to be 10% per year, it seems reasonable to assume that the portfolio will last forever. If this were modeled on a portfolio of $5,000,000 it would look like “Example Portfolio 1”.

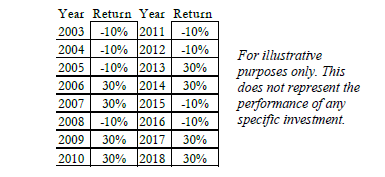

This method of looking into the future is popular because it is clean and is sensible on its surface. This method is appropriate when looking at a fixed, guaranteed where rates and asset values do not fluctuate. However, if there is any variability in return from year to year as there is in normal investment markets, this method is unsatisfactory. This deterministic model fails to take into consideration inconsistent returns of the investment markets. Another method of modeling is to analyze portfolios using historical performance to see if a portfolio structure would have worked in the past but as I have said we are not as concerned with the present value of past decisions as we are with the future value of current decisions. Does the order in which returns are achieved have any impact on the long-term value of the investor’s assets? “Example Portfolio 2” is the same as “Portfolio Example 1”, however, instead of achieving 10% each year for 15 years, they achieved returns as follows:

The timing of returns is far more important than the average return. Both examples have an arithmetic average performance of 10%, but in fact the returns were not 10% each year. The second example had an enormous impact on the value of the investor’s portfolio at the end of the 18 years. In example 2, if the investor continues spending $300,000 per year he/she is now using a higher percentage of the assets rather than the original 6% (also, this is not adjusted for inflation, taxes or investment expenses).

The above example is only one comparison of many that are possible given an uncertain future.

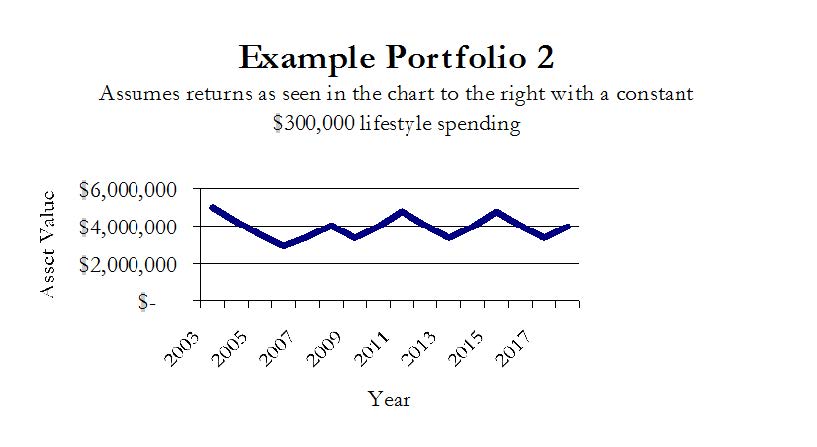

How does one gain a perspective on what future values of their investment portfolio may be if they know they will be spending money from their portfolios? The answer is found in a tool called

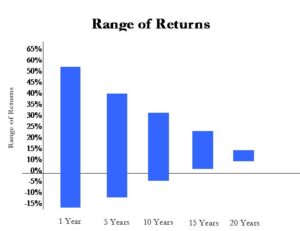

Monte Carlo Simulation. As the name implies it was developed to determine the likelihood of wins and losses in games of chance but the process lends itself well to the investment markets. It is a method of random distribution modeling that can take into consideration hundreds or even thousands of different possible outcomes to determine the probability of success or failure of an investor’s choice before investing. From a given starting point the Monte Carlo Simulation shows the range of potential asset values based on multiple potential outcomes over time rather than a single outcome as illustrated to the left.

Using the same asset and spending level from the above example, we run a simulation. This method of modeling returns allows us to look into the future and understand the probability that we are going to run out of money. Armed with this information, the investor can now better understand the potential outcomes and make better decisions.

To this point we have discussed the personal, theoretical and historical sides of the investment process by examining: values, goals, potential returns, taxation, inflation, risk, asset allocation etc. These are all necessary elements of preparation for the proper management of an individual’s wealth management strategy. I have been approaching the investment process from the opposite direction of the typical greed/fear based marketing presentation because I feel that it is important for investors to answer as many questions as possible before they start investing. In the next article titled, “Beyond Cash, Stocks and Bonds” we are going to move from theory to practical application. We will review the different methods for purchasing securities in an investment portfolio.