A case study designed to help understand values and goals in relation to personal circumstances. This article and the next will be used to help define financial independence.

In the previous article, we defined values and goals as they relate to the development of your wealth management strategy. Since the range of individuals’ goals can be infinitely large I am going to introduce you to John and Betty Smith. They are a fictitious couple loosely based on a family I did some work for a few years ago. They will be used to illustrate an example of values, goals and realistic expectations. Much of the reasoning used in the scenario can be used to help understand the characteristics of your own circumstances.

Scenario

John and Betty are 57-years-old and have been married for 31 years. They have four children and five grandchildren. Two months ago, the Smiths closed the sale of their business and have decided they may want to retire and follow their personal interests, rather than pursue another business opportunity. Our job is to determine if their assets are sufficient to provide for the goals they have set.

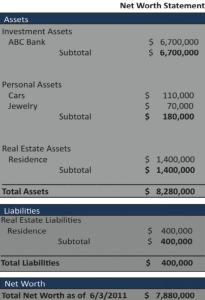

The Smiths home is valued at $1,400,000; they have a $400,000 mortgage on this home. They have $6.7 million in investment assets (mostly cash from the sale of their business). The value of their personal assets is estimated at $180,000 (cars, jewelry, etc.). The Smiths have no liabilities other than their mortgage. Combining these assets and liabilities as listed in the sample Net Worth statement below you can see that their net worth is $7,880,000.

Because of their assets one may reason that the Smith’s can achieve any reasonable goal. However, we need to determine if the Smiths can achieve their specific goals within their available means. For our purposes we need to determine how much each of the Smiths’ goals costs immediately and in the future. We also need to determine which of their assets produce future income and which do not. At this point the Smiths do not expect outside sources of income. They wish to know if their investment assets will be enough to satisfy all of their goals without interruption for the rest of their lives. It is important to the Smiths that in addition to providing for all of their lifestyle needs listed below that they leave a significant inheritance to their children, grandchildren and their favorite charities.

Defining the cost of their goals

Financially secure retirement; John and Betty Smith worked diligently to align their values with their personal goals then they estimated the real cost of each element. By completing this work they were able to determine that their desired retirement lifestyle requires $240,000 per year after taxes. In addition, they wish to gift $20,000 annually to each of their four children ($80,000 total gifts annually). Since much of their success and satisfaction in life has been based on their education, it is a priority for them to help support the education of their grandchildren. For this purpose they wish to set aside $60,000 for each of their five grandchildren ($300,000 one time contribution). Regarding their mortgage, neither John nor Betty has ever been comfortable with debt so they wish to pay off the remaining $400,000 home mortgage balance. Lastly, they wish to donate $40,000 annually to their favorite charities.

Characteristics of the Goals

As we examine the characteristics of their goals we notice that two of the goals, education of their grandchildren and paying off their mortgage, are onetime, lump sum expenses. The other three goals, lifestyle needs, gifts to children and charitable contributions, require annual expenditures. At this point it’s important to separate these two types of goals.

As noted above the Smiths are starting with $6,700,000 in cash and after satisfying the payment of their $400,000 mortgage and the $300,000 funding of the education accounts for their grandchildren there will be $6,000,000 remaining to satisfy their annual goals. When the annual goals of lifestyle needs of $240,000, family gifts of $80,000 and charity of $40,000 are added together they total $360,000 per year. This represents the total estimated amount of annual spending the Smiths require.

Use Assets and Productive Assets

An important question to consider at this point is; Why are we only considering $6,700,000 for the satisfaction of their goals rather than their entire $7,880,000 Net Worth? The answer is that we need to divide assets into two types; Use Assets and Productive Assets. Some of the Smiths’ assets, such as their $6.7 million in cash, will be made available for investment, which will provide income and growth. This will help them reach their financial goals, so we refer to these as productive assets. They are not considering selling their $1,400,000 home or their $180,000 of personal assets, so any income or growth that could potentially be derived from these assets will not be considered at this time; that distinction makes these their use assets. As I said above the Smiths plan to remove $300,000 to fund the future education of their grandchildren and $400,000 to pay off their mortgage. With those adjustments their revised Net Worth Statement is listed below. I have drawn a line separating their use assets from their productive assets. Note that the lump sum for the funding of their grandchildren’s education has removed $300,000 from their net worth. Also note that paying off their mortgage didn’t reduce their net worth it just moved $400,000 from their productive assets to their use assets.

As you can see, after satisfying two of their immediate lump sum goals, their Net Worth is $7,580,000 and their productive assets are $6,000,000. To this point we have determined what the Smiths goals are and what those goals will cost. We have also listed their assets and divided those assets between their productive assets and use assets. To answer their initial question we need to determine whether the Smiths, with $6,000,000 of productive assets, can satisfy their annual spending needs of $360,000 without interruption for the rest of their lives while also leaving a substantial amount to their heirs and favorite charities.

Values, Goals and Financial Independence

This discussion boils down to a few things: Each of us has our own set of values and goals and they are as unique as we are. Each of these goals has a cost in dollars and cents. Once this cost is determined, we can decide if the resources we have (or will have) are sufficient to provide the income necessary to satisfy those goals. When our assets and/or other resources are enough to provide for our goals then we are financially independent. When they are not enough we are not financially dependent. From this explanation you will notice that financial independence is not a dollar figure that says, “When I have five million, 25 million or even 100 million dollars I will be financially independent.” The real definition of financial independence is when you have enough resources to provide the lifestyle that you have determined that you want, given the realistic potential of the investment markets to provide it.

There are families that are financially independent with relatively little, and there are families with what most would consider vast fortunes that are not financially independent. I have drawn my version of the financial independence chart below.

The Smiths have decided what it will take to live their desired lifestyle. Now we need to help them determine if their assets are enough to provide it. Do you feel, given the information supplied, that they are financially independent? Do you feel that their lifestyle needs can be met for the rest of their lives without interruption with the resources they currently have?

The Smiths have decided what it will take to live their desired lifestyle. Now we need to help them determine if their assets are enough to provide it. Do you feel, given the information supplied, that they are financially independent? Do you feel that their lifestyle needs can be met for the rest of their lives without interruption with the resources they currently have?

This discussion continues in the next article titled “Realistic Expectations”.

If you have any questions or comments please email me directly at Bob.Bancroft@wtlcourse.com